Business • News • News

Grupo Argos has agreed to a transaction that transfers its investment in Grupo Nutresa's food business in exchange for shares of Grupo Sura and Grupo Argos

16 June 2023- The agreement reached with JGDB and Nugil (companies controlled by Jaime Gilinski), IHC Capital Holding, Grupo Nutresa, and Grupo Sura establishes that Grupo Argos will exchange its stake in Grupo Nutresa’s food business, receiving shares of Grupo Sura and a stake in Grupo Nutresa’s portfolio of shares, which in turn consists of ordinary shares of Grupo Argos and Grupo Sura.

- The final result of this transaction implies that for each share (1.0) of Grupo Nutresa, Grupo Argos will receive 0.96 shares of Grupo Sura and 0.28 shares of Grupo Argos.

- With the exchange, JGDB, Nugil, and IHC Capital Holding will cease to be shareholders of Grupo Sura and become controlling shareholders of Grupo Nutresa’s food business, a company that will no longer be a shareholder of Grupo Argos and Grupo Sura. Likewise, Grupo Argos will no longer be a shareholder of Grupo Nutresa (food business).

Grupo Argos has subscribed a Framework Agreement that establishes the terms for the exchange of its stake in Grupo Nutresa’s food business, a transaction that generates value for Grupo Argos and all its shareholders, while strengthening the company to continue executing its strategy.

“The arrival of a new global investor to Grupo Nutresa with the desire to grow its operational platform not only represents an opportunity for value creation for all its shareholders but also allows us to maintain the principles that have historically characterized the organization, preserving over 46,000 jobs and investment in the country.

Furthermore, it is a step towards the consolidation of Grupo Argos as an asset manager and enables us to safeguard the rights of all the company’s shareholders. Grupo Argos and Grupo Sura will continue to advance in the processes of seeking partners and strategic alternatives to maintain their focus on their core businesses.”

Jorge Mario Velásquez – Grupo Argos CEO

This transaction generates value for Grupo Argos and all its shareholders because, among other reasons, they will receive a significant block of shares from Grupo Sura and Grupo Argos with reasonable exchange terms that represent favorable economic and strategic conditions. The company has full confidence in its infrastructure business plans.

Transaction summary

Below is a step-by-step description of the transaction structure that will be subject to approval by the competent authorities and corporate governance bodies to materialize the exchange agreed in the memorandum of understanding signed in Madrid, Spain, on May 24, 2023:

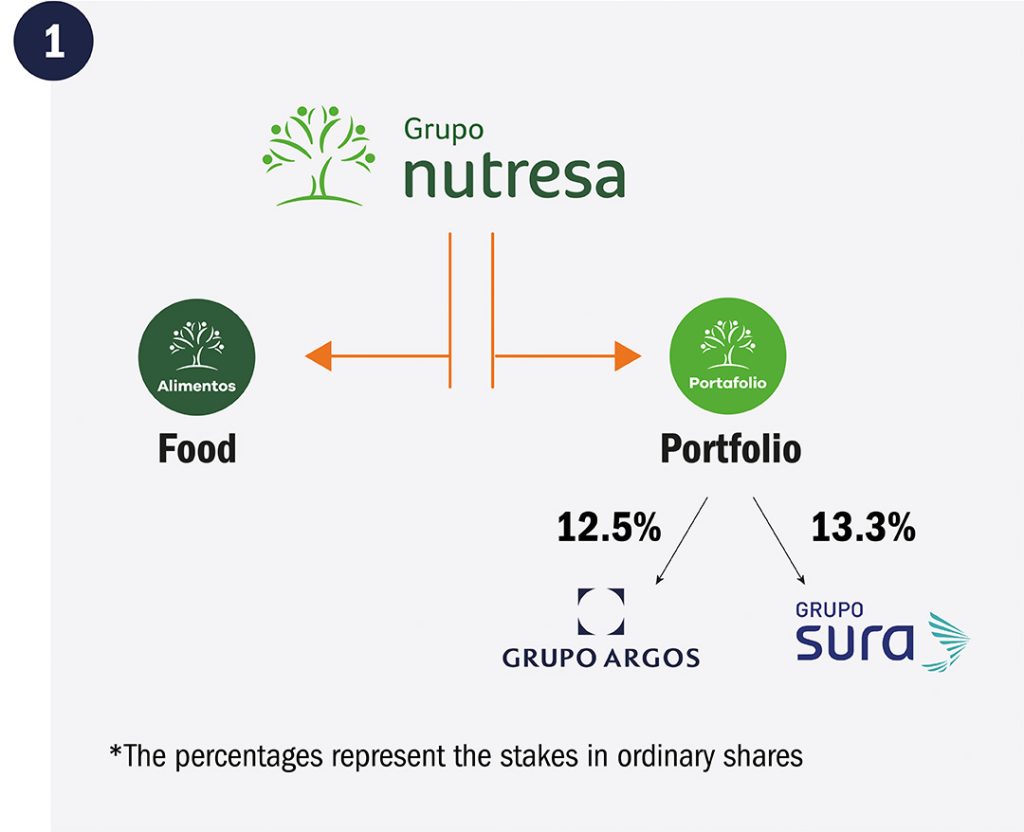

1. Mirror Spin-off of Grupo Nutresa

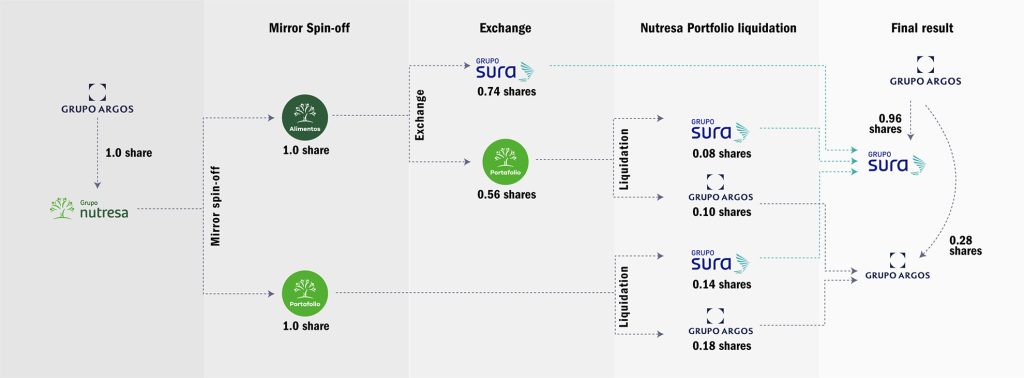

The transaction contemplates subjecting the mirror spin-off of Grupo Nutresa upon the approval of its shareholders’ assembly, an operation that will result in two companies listed on the Colombian Stock Exchange: one that will continue to be the owner of the operating business (food) and a new company that will be the owner of Grupo Nutresa’s current investments in Grupo Argos and Grupo Sura (portfolio).

For each share of Grupo Nutresa, once this spin-off is carried out, each shareholder will retain one share of the food company and receive one share of the new portfolio company.

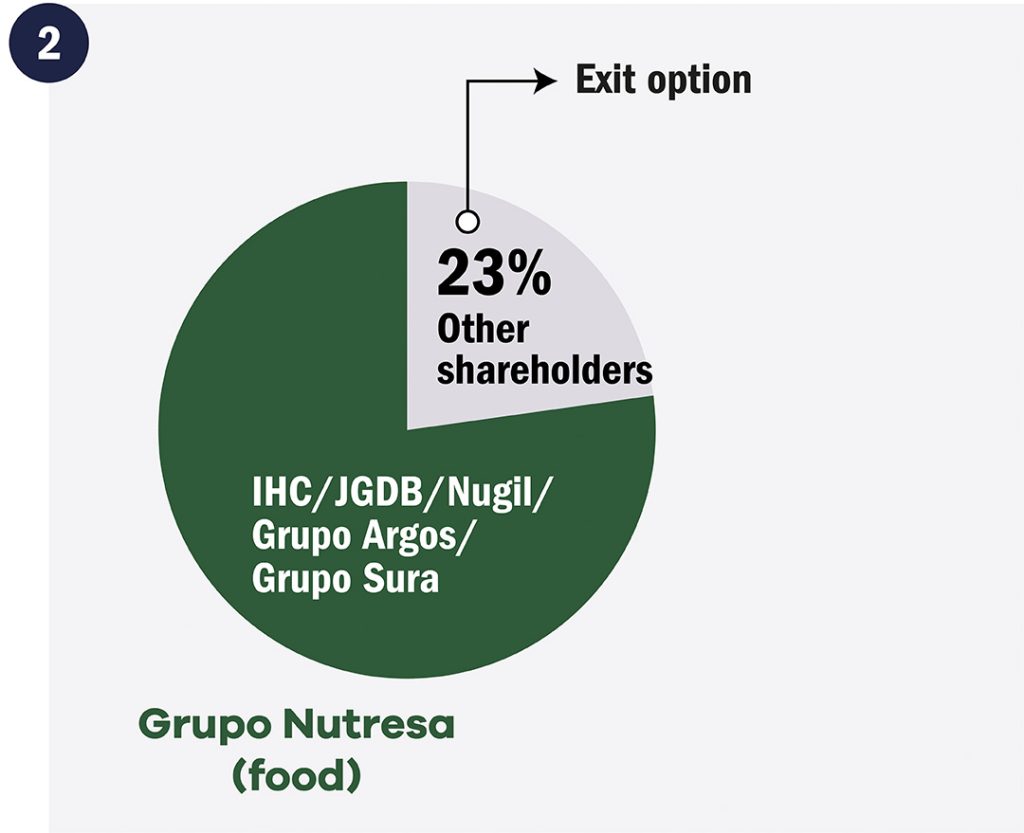

2. Public Exchange Offer for up to 23% of Grupo Nutresa (food):

Following the spin-off, Grupo Argos and Grupo Sura will make a Public Exchange Offer for a stake of up to 23.1% in Grupo Nutresa (food). All shareholders of Grupo Nutresa (food) will have three options to choose from:

- a) Sell in cash at a value of USD 12 per share (considering that, as a result of the spin-off, they preserve their stake in the new portfolio company).

- b) Exchange their Grupo Nutresa (food) shares for shares of Grupo Sura and the new portfolio company. For each share of Grupo Nutresa (food), the shareholder will receive 0.74 shares of Grupo Sura and 0.56 shares of the new portfolio company. Once this company is liquidated, as described below, the shareholder will ultimately receive a total of 0.96 shares of Grupo Sura and 0.28 shares of Grupo Argos (these are the same terms that Grupo Argos and Grupo Sura will have in the exchange).

- c) Remain as shareholders of Grupo Nutresa (food). Grupo Argos will participate proportionally with 22% of the offer, while Grupo Sura will participate with 78%. Any additional participation beyond the 10.1% included in the understanding agreement acquired in this offer will be refunded in cash to Grupo Argos and Grupo Sura by IHC Capital Holding, Nugil, or JGDB, at a price of USD 12 per share.

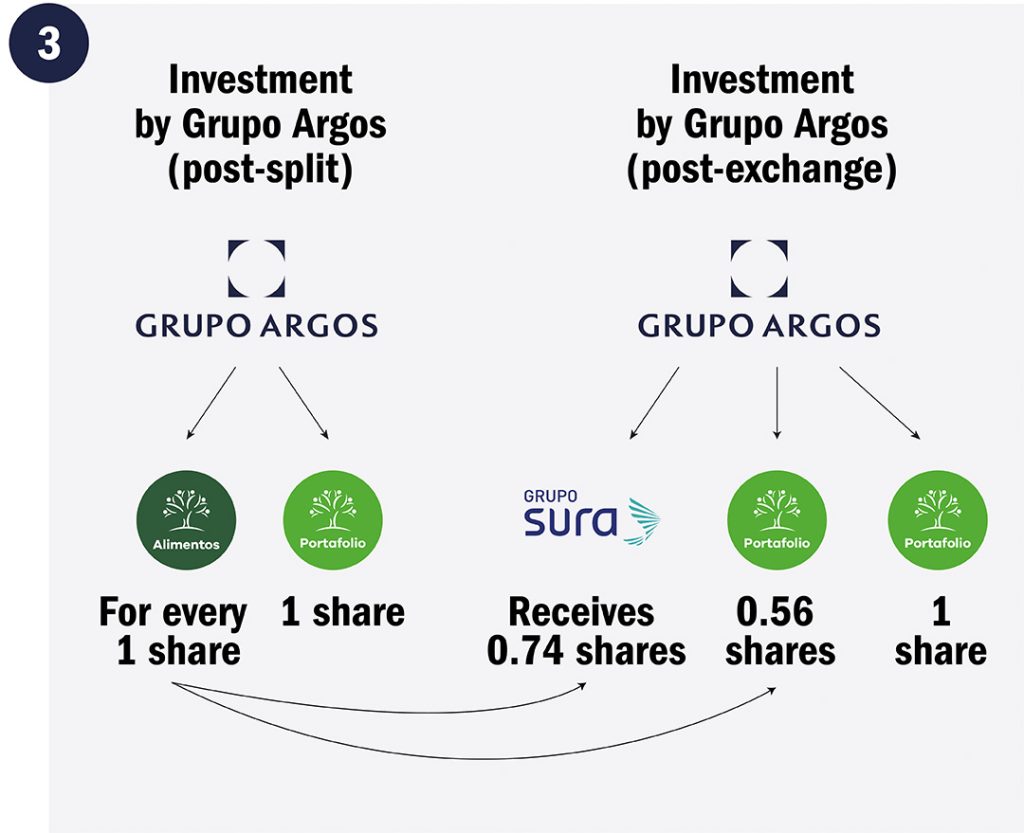

3. Share Exchange

Upon completion of the Public Exchange Offer, Grupo Argos will exchange its stake in Grupo Nutresa (food) with JGDB, Nugil, and IHC Capital Holding, receiving shares of Grupo Sura and the new portfolio company in return. The transaction involves the exchange of 254 million shares of Grupo Nutresa (56%) – which would allow JGDB, Nugil, and IHC Capital Holding to reach up to 87% ownership in Grupo Nutresa as established in the understanding agreement – for 189 million shares of Grupo Sura (41%) and 144 million shares of the new portfolio company (31%). This means that, in this phase of the transaction, for each share (1.0) of Grupo Nutresa (food), Grupo Argos will receive 0.74 shares of Grupo Sura and 0.56 shares of the new portfolio company.

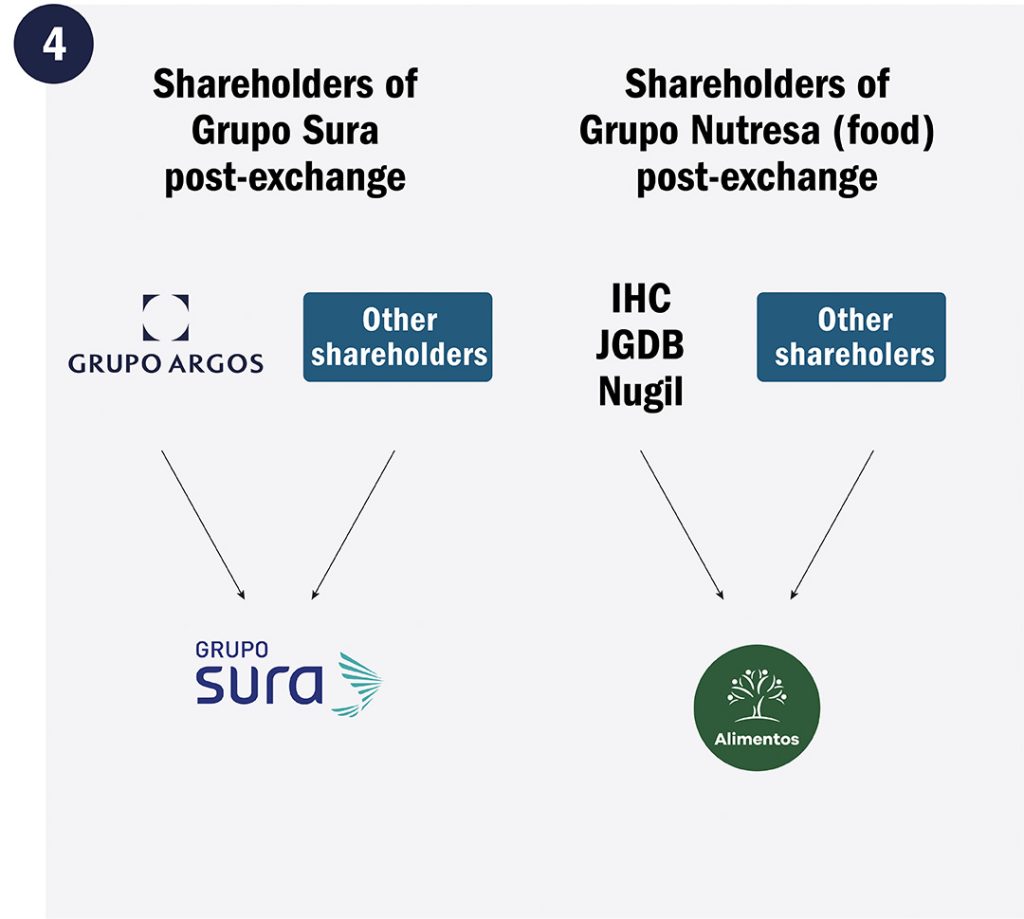

4. Post-Exchange Structure

Once the share exchange is completed, JGDB, Nugil, and IHC Capital Holding will no longer be shareholders of Grupo Sura. Additionally, Grupo Nutresa (food) will not have any shareholding in Grupo Argos and Grupo Sura.

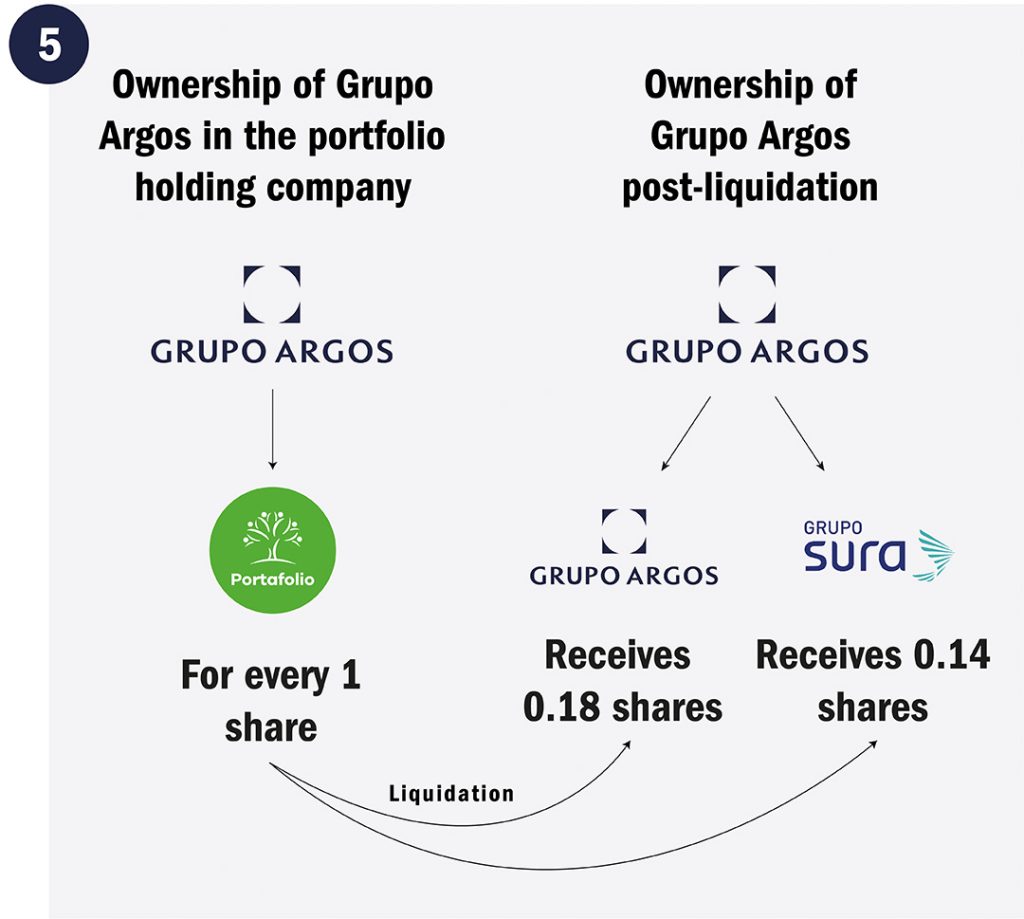

5. Liquidation of the New Portfolio Company:

After all the transaction operations are executed, the liquidation of the new portfolio company will be subject to the decision of its shareholders. This will involve each shareholder receiving shares of Grupo Argos and Grupo Sura. For each share (1.0) of this company, each shareholder will receive 0.14 shares of Grupo Sura and 0.18 shares of Grupo Argos.

Transaction Summary for Grupo Argos: Flowchart per share in Grupo Nutresa

The chart at the top illustrates the steps described in the previous sections. In summary: for each share (1.0) that Grupo Argos holds in Grupo Nutresa (current), it retains one share (1.0) in Grupo Nutresa (food) and receives one share (1.0) from the new portfolio company. Subsequently, Grupo Argos will exchange its shares in Grupo Nutresa (food) (1.0) with JGDB, Nugil, and IHC Capital Holding for shares of Grupo Sura (0.74) and shares of the new portfolio company (0.56). Following that, the new portfolio company would be liquidated, in which case Grupo Argos will receive additional shares of Grupo Sura and Grupo Argos.

In conclusion, for each share that Grupo Argos holds in Grupo Nutresa (pre-spin-off), it will receive 0.96 shares of Grupo Sura and 0.28 shares of Grupo Argos.

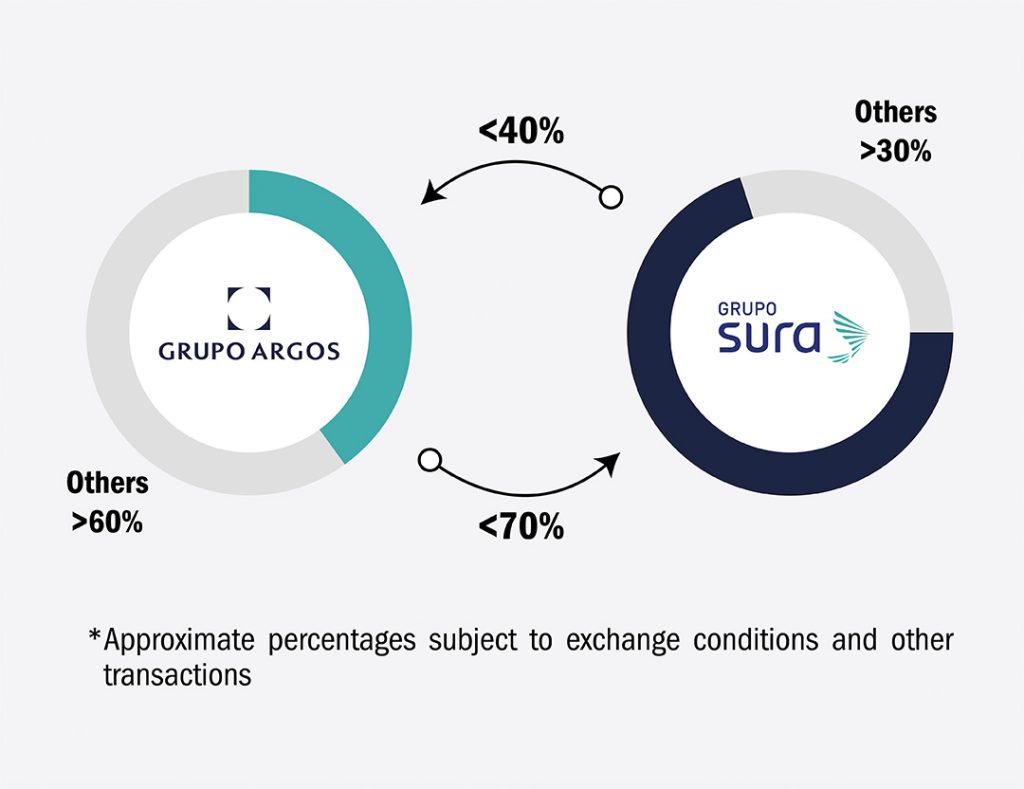

Upon completion of the whole transaction, Grupo Argos will absorb all the shares it receives from itself, resulting in an increase in ownership for all its shareholders. Similarly, Grupo Sura will absorb its own shares, increasing the ownership for its remaining shareholders, including Grupo Argos.

Considering that Grupo Argos’s interest is to continue consolidating as an infrastructure asset manager rather than controlling Grupo Sura, once it receives the shares of that company, it will transfer that additional ownership to an irrevocable trust. The purpose of this trust will be to prevent the exercise of political rights, retaining only the economic rights of those shares until a divestment mechanism or other alternatives are established to capture value from that portfolio.

In this regard, both Grupo Argos and Grupo Sura will continue to seek strategic partners to focus all their investments on their core businesses, enabling them to continue revealing and maximizing value for their shareholders.

Grupo Argos will convene a Shareholders’ Meeting to decide on potential conflicts of interest involving some members of its Board of Directors. Following this, the Board will deliberate and decide on this transaction.

For the implementation of the operations, government authorizations, including but not limited to those required by the Colombian Financial Superintendency or any other authority, will be processed.

This deal represents an evolution for Grupo Nutresa, ensuring value creation for all its shareholders while preserving the company’s relevance to Medellín, Antioquia, and Colombia. At the same time, it provides this regional reference in the food industry with an additional financial lever to drive its global growth.

1 For the structuring of this transaction, Grupo Argos has received strategic and financial advice from J.P. Morgan, and legal counsel from Skadden, PPU, and Londoño & Arango. The company will hold an investor conference on Tuesday, June 20th, to explain the terms of the agreement in detail.

Mas noticias

-

Brand

Brand -

Employer Brand

Employer BrandGrupo Argos and its companies once again rank among the best places to work in Colombia, according to Merco Talento 2025

5 June 2025 Read more -

Business

BusinessWith COP 40 trillion in building materials and infrastructure projects, Grupo Argos continues to advance its strategic transformation

5 June 2025 Read more -

News

NewsGrupo Argos and its companies, Cementos Argos and Celsia, reaffirm their leadership among the most sustainable companies in Colombia, according to Merco

26 February 2025 Read more -

Grupo Argos Foundation

Grupo Argos FoundationEight farming families in Valle del Cauca received the international quality certification recognizing them as protectors of the Andean Bear in Colombia

21 February 2025 Read more