Financial results • News

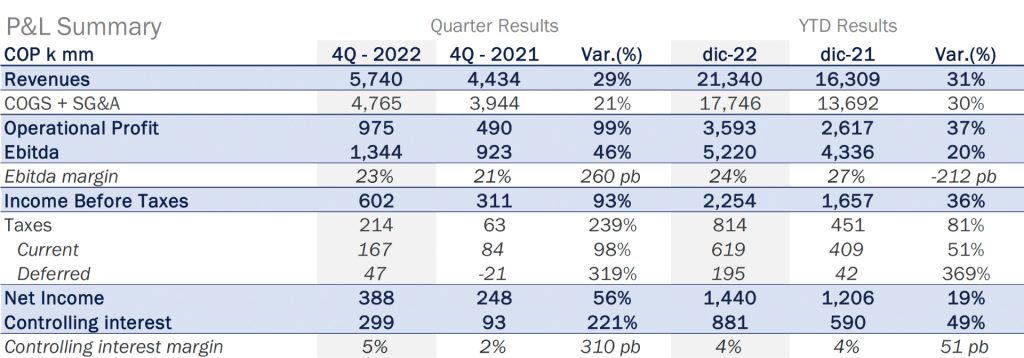

Grupo Argos had record historic results as of the fourth quarter of 2022: Accumulated consolidated revenue was COP 21.3 trillion (+31%), EBITDA was COP 5.2 trillion (+21%), and net income was COP 1.4 trillion (+19%).

28 February 2023- These outstanding figures were accompanied by a deleveraging policy that, over the last three years implied a reduction of over COP 3 trillion in in net debt.

- Grupo Argos, Cementos Argos and Celsia will submit a share buyback program for authorization from the Shareholders’ Meeting. The aggregate amount of this program could exceed COP 1.0 trillion.

- Cementos Argos reported the highest operating EBITDA in its history, reaching COP 2.1 trillion, and closed with a net debt/EBITDA ratio of 2.8x, the lowest in the last nine years. Celsia achieved historic results with revenues that reached COP 5.6 trillion and an ebitda of close to COP 1.8 trillion, growing 30% compared to the previous year. Odinsa ended 2022 having made a full recovery of roadway and airport traffic, which grew 15% and 63%, respectively.

In 2022 Grupo Argos achieved historical financial results for its almost 90 years in existence. Consolidated operational results allowed the company to close out the year with COP 21.3 trillion in cumulative revenue, growing 31% compared to the previous year, and EBITDA of COP 5.2 billion, a 21% increase. Net income ended the year at COP 1.4 trillion, growing 19%, and net income to the majority shareholders was COP 881 billion, growing 49%. All consolidated metrics grew by double digits, a testament to its companies positive operating performance.

“We celebrate our results in 2022 that constitute the highest in Grupo Empresarial Argos’s history and ratify the organization’s fundamentals and its commitments to generate value for our shareholders, who will receive over COP 1.2 trillion in dividends and up to COP 1.0 trillion in distributions via the share buyback.” Jorge Mario Velasquez Grupo Argos CEO

Cementos Argos reported the highest operating EBITDA in its history. Efforts to mitigate inflationary pressure and energy costs resulted in an EBITDA of COP 2.1 trillion, which in turn allowed the net debt/EBITDA ratio to close at 2.8x, the lowest of the last nine years. On the other hand, the consolidated net cash position ended with a balance of COP 1.3 trillion at the end of the year. The company achieved record exports of 1.2 million tons, a 28% increase over 2021. Concrete volumes in Colombia increased 14%, driven by close to 30% year-over-year growth in construction licenses in the country.

Celsia also achieved historic results. Consolidated revenue reached COP 5.6 trillion, with an EBITDA of close to COP 1.8 trillion, growing 30% compared to the previous year. Consolidated net profit closed at COP 442 billion. During 2022, Grupo Argos’s energy company continued adding assets to generate clean and reliable energy for Colombia and the region. Highlights include the El Tesorito Thermoelectric Plant in Sahagún, Córdoba, with an installed capacity of 200 MW, the commissioning of 80 MW in solar farms, and the construction of an additional 172 MW of solar. With its solar generation capacities, Celsia continues its consolidation as a key actor in the country’s energy transition.

Odinsa ended 2022 having made a full recovery of its roadway and airport traffic. Traffic along road concessions ended the year at over 39 million vehicles, an increase of 15% compared to the previous year. This performance resulted in higher internal rates of return for each concession. A highlight was the performance of Túnel de Oriente, where average daily traffic increased 30% compared to the previous year and reached the levels estimated for 2032. In turn, airport traffic ended the year at 40.7 million passengers mobilized, growing 65% compared to 2021. Thanks to operations performed by the company throughout the year, Odinsa prepaid COP 1.2 trillion in debt, which leaves it in a situation of significant financial flexibility for upcoming business opportunities.

Grupo Argos’ Urban Development Business recorded revenues of COP 224 billion in 2022, which resulted in a net cash flow of almost COP 100 million. Over the next five years this business has signed sales agreements that will represent cash revenues of COP 350 billion for the company.

Stock buyback programs

Although Grupo Argos’s companies achieved extraordinary results in 2022 that reaffirm the organization’s structural soundness and its value generation capacity, the price its shares currently trade on the Colombian Stock Exchange are far from the company’s true value. In light of the above, the Grupo Argos Board of Directors authorized the start of a stock buyback program approved at the Ordinary Shareholders’ Meeting in 2020, as reported at that time and using the relevant information mechanism, and agreed to bring another buyback program before the 2023 Shareholders’ Meeting for an amount that could ascend to COP 500 billion, intending to bring continuity to the current program that ends in March. The aggregate amount of Grupo Empresarial Argos’s buyback programs, including the buyback projects announced by Cementos Argos (COP 250,000 million) and Celsia (COP 300,000 million), could exceed COP 1 trillion.

Summary consolidated financial results

Mas noticias

-

Employer Brand

Employer Brand -

Financial results

Financial resultsGrupo Argos reported a net income of COP 2.2 trillion in the first quarter of 2025

15 May 2025 Read more -

Financial results

Financial resultsGrupo Argos quintupled its consolidated net income in 2024, reaching COP 7.6 trillion, and will focus 100% on infrastructure

26 February 2025 Read more -

Grupo Argos Foundation

Grupo Argos FoundationEight farming families in Valle del Cauca received the international quality certification recognizing them as protectors of the Andean Bear in Colombia

21 February 2025 Read more -

Financial results

Financial resultsGrupo Argos closed 2024 by more than tripling its separate net income, reaching COP 2.5 trillion.

30 January 2025 Read more