Financial results

Grupo Argos reported a net income of COP 2.2 trillion in the first quarter of 2025

15 May 2025- Excluding non-recurring events, revenue grew by 3% and EBITDA increased by 25%, while consolidated net income rose by 236%.

- During the quarter, Grupo Argos submitted the request for approval of the Spin-Off Project to the Colombian Financial Superintendence, marking a key milestone in its strategy to end cross-shareholdings with Grupo Sura and focus its investment portfolio on infrastructure.

- BRC Ratings – S&P Global reaffirmed Grupo Argos’ AAA issuer rating and the rating of its ordinary bonds, underscoring the company’s structural strength.

Grupo Argos submitted to the Colombian Financial Superintendence the request for authorization of the Partial Spin-Off by Absorption Project, as approved by its Shareholders’ Meeting, aiming to end the cross-shareholdings with Grupo Sura. This transaction involves the distribution of over COP 10.8 trillion in Grupo Sura shares to Grupo Argos shareholders and represents a strategic step toward focusing the company’s portfolio on infrastructure and building materials businesses, which, as previously stated, will bring significant benefits to the organization, its shareholders, and the Colombian capital market.

On the operational front, Grupo Argos reported its consolidated financial results for the first quarter of 2025, a period in which, excluding non-recurring events, it achieved pro forma growth in revenue, operating profitability, and net income, driven by a more favorable environment for its energy business, the appreciation of its road and airport concession assets, and disciplined operational and financial management across all its platforms.

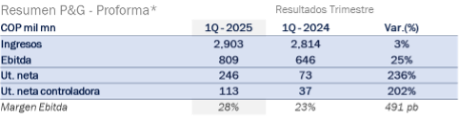

In pro forma consolidated results, which exclude non-recurring effects recorded in 2024 and 2025, the company reported revenues of COP 2.9 trillion, up 3%, while EBITDA reached COP 809 billion, growing 25%. Pro forma consolidated net income for the period was COP 246 billion, representing a 236% increase.

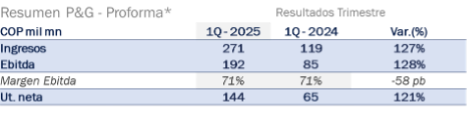

Additionally, pro forma separate revenues for the first quarter amounted to COP 271 billion, growing 127% year-over-year, with EBITDA reaching COP 192 billion, up 128%, and net income totaling COP 144 billion, 121% higher than in 2024.

Grupo Argos began the year with growing operational results and a strong cash position. This financial strength, coupled with debt reduction and the execution of an efficiency program across all businesses, translated into significantly higher operating and net profits. We continue to identify opportunities to deploy capital with a long-term perspective for the benefit of all our shareholders.

Jorge Mario Velásquez, CEO of Grupo Argos

During the first quarter of the year, Cementos Argos completed the sale of its stake in Summit Materials. The proceeds from this transaction are currently invested in highly liquid financial vehicles with no market risk exposure, while the company undertakes a comprehensive analysis of strategic alternatives for their use. From a financial standpoint, Grupo Argos’ construction materials company reported revenues of COP 1.2 trillion and adjusted EBITDA of COP 258 billion, with a 21% margin. Adjusted net income reached COP 137 billion, reflecting an 8% year-over-year growth.

Celsia reported revenues of COP 1.45 trillion, up 6% year-over-year, and EBITDA of COP 472 billion, increasing 45%, with a 32.5% margin. Net income totaled COP 108 billion, a 264% increase compared to the previous year. This performance was driven by improved hydrology conditions and normalized generation costs. The company also made progress in its energy transition strategy, highlighted by the construction of the Carreto Wind Farm in Atlántico and the acquisition of a 675 MW portfolio of large-scale non-conventional renewable energy projects.

Odinsa recorded revenues of COP 131 billion, EBITDA of COP 109 billion, and net income of COP 99 billion. These results reflect the appreciation of road assets and dividends received during the quarter. In the road segment, the main bridge of the interchange connecting José María Córdova Airport with the Oriente Tunnel in Antioquia was opened to traffic. In the airport segment, El Dorado International Airport was once again recognized as South America’s Best Airport by Skytrax, adding to the Platinum Award for Operational Excellence granted by Cirium in 2025.

Additionally, in May, BRC Ratings – S&P Global reaffirmed Grupo Argos’ AAA issuer rating and the rating of its ordinary bond program, as well as the BRC 1+ rating for its commercial paper, recognizing the structural strength the company will maintain after completing the transaction with Grupo Sura, as well as the consistency in executing its strategy and the resilience of its businesses.

Moreover, Grupo Argos’ preferred shares regained eligibility for repo operations on the Colombian Stock Exchange, thanks to a significant improvement in liquidity. So far in 2025, the trading volume has been six times higher than in 2023, reflecting the increased attractiveness of the stock and the company’s progress in its strategy to unlock shareholder value.

Financial Results Summary

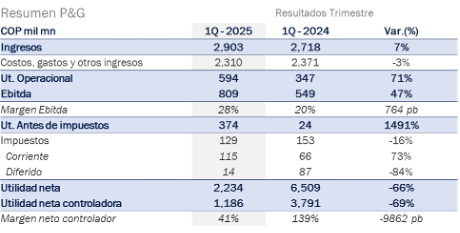

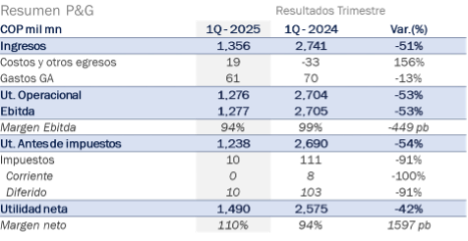

To provide a clearer view of operational performance, Grupo Argos presents pro forma results excluding the following non-recurring events:

- In 2025: profit from the sale of Summit Materials (COP 2.0 trillion), expenses associated with the Spin-Off Project, and the exclusion of the equity method from Grupo Sura.

- In 2024: profit from the asset combination between Argos USA and Summit Materials (COP 5.3 trillion), profit from the divestment in Grupo Nutresa (COP 1.4 trillion), accounting impairments due to property adjustments (COP 200 billion), and the reclassification of Grupo Sura as a discontinued operation.

The exclusion of these effects provides a more accurate view of the company’s structural business growth.

Consolidated Financial Statements

Pro forma

Separate Financial Statements

Pro forma

Accounting figures

Accounting figures

Mas noticias

-

Financial results

Financial results -

Financial results

Financial resultsGrupo Argos quintupled its consolidated net income in 2024, reaching COP 7.6 trillion, and will focus 100% on infrastructure

26 February 2025 Read more -

Financial results

Financial resultsGrupo Argos closed 2024 by more than tripling its separate net income, reaching COP 2.5 trillion.

30 January 2025 Read more -

Business

BusinessWith solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months

14 November 2024With solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months.

Read more -

Corporate

CorporateGrupo Argos reports a net profit of COP 2.6 trillion from its divestment in Nutresa and shows a 41% growth in its EBITDA

14 August 2024Grupo Argos reports a net profit of COP 2.6 trillion from its divestment in Nutresa and shows a 41% growth in its EBITDA

Read more