Financial results

Grupo Argos recorded consolidated net income of COP 4.1 trillion

14 November 2025- This consolidated result is equivalent to COP 5,850 in earnings per share and was driven by the simplification of its corporate structure, the monetization of its presence in the United States, and the strength of its businesses. In total, the company has generated consolidated net income of COP 11.7 trillion since 2024 (COP 7.6 trillion in 2024 and COP 4.1 trillion in the year-to-date 2025).

- The company’s shareholders’ portfolio has appreciated by COP 3.0 trillion since the completion of the Spin-Off Project in July 2025.

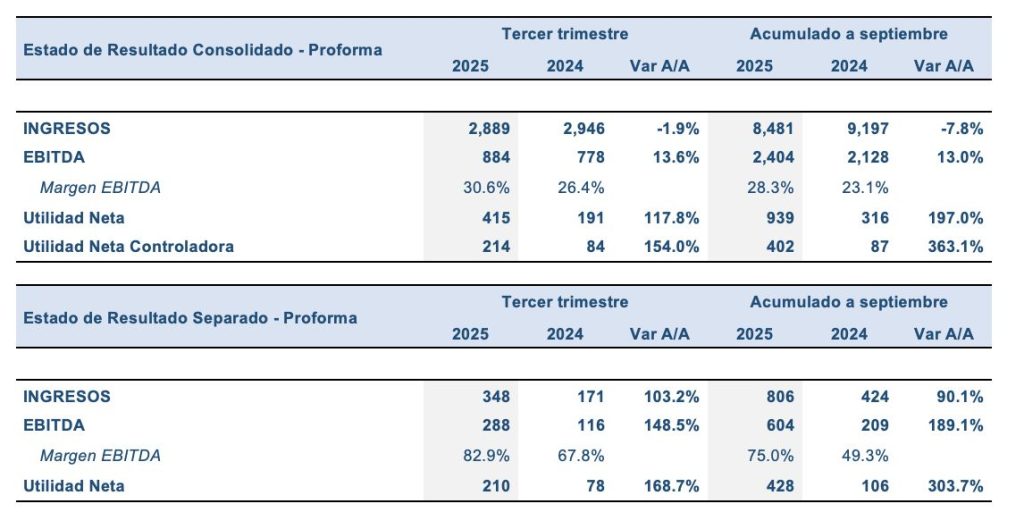

- Excluding non-recurring events, consolidated EBITDA was COP 2.4 trillion, up 13%; net income was COP 939 billion, an increase of 197%; and controlling net income reached COP 402 billion, up 363%.

- Operating performance was driven by higher contributions from hydropower generation at Celsia, higher revenues at Odinsa associated with the appreciation of its assets, and greater profitability at Cementos Argos.

Year-to-date 2025, Grupo Argos shareholders have recorded an appreciation of their investment of more than 49%, driven by the simplification of the portfolio, the achievement of strategic milestones, and the solid operating performance of the group’s businesses. Considering the sum of the value of the Grupo Argos common share and the 0.23 Grupo Sura common shares they received for each share following the Spin-Off, the appreciation stands at 49.5%. Applying the same exercise to the preferred share, the appreciation rises to 53.4%.

“During the third quarter, we took decisive steps to advance our business plan and continue to unlock value for our shareholders: Cementos Argos executed a share repurchase in which Grupo Argos participated, with the aim of using the proceeds to reduce the company’s indebtedness; we moved forward with the aggregates export platform to the United States; we launched Atera through the alliance between Celsia and Brookfield; and we created Odinsa Aguas as a new high-potential vertical.”

Jorge Mario Velásquez, Chief Executive Officer, Grupo Argos.

The company achieved progress in the execution of its project portfolio, including:

- The execution of Cementos Argos’ share repurchase for approximately COP 900 billion, using proceeds from the gains obtained from the divestment of its operations in the United States. Through its participation, Grupo Argos received COP 493 billion, which will be used to reduce its net debt.

- Cementos Argos continues to strengthen its aggregates export platform to the United States, a growth initiative through which it expects to increase its EBITDA by more than USD 150 million in the coming years, leveraging synergies with its privileged geographic footprint in the Caribbean, Colombia, and Central America.

- Celsia announced the creation of Atera, an energy-efficiency company formed in partnership with Brookfield that designs, finances, installs, and operates solutions for industrial clients. Atera starts with more than 500 customers and an investment plan of over USD 500 million through 2030. With this transaction, Celsia received proceeds that enabled it to reduce its consolidated debt by more than USD 100 million.

- In Peru, Celsia is moving forward with the construction of the 218 MW Caravelí wind farm, which is 50% complete and will begin operations in 2026.

- The financial close for COP 1.8 trillion for the expansion of the Oriente Tunnel and the start-up of all work fronts.

- The creation of Odinsa Aguas, a water infrastructure investment platform that complements its road and airport operations with an initial entry into Mexico. The platform will focus on wastewater treatment and reuse and seawater desalination in Latin American countries facing high water stress.

Operating results focused on profitability

In the quarter, Cementos Argos posted an EBITDA margin of 26%, an expansion of more than 300 basis points compared to the same period in 2024. Year-to-date, Cementos Argos’ consolidated revenue reached COP 3.9 trillion and adjusted EBITDA COP 928 billion, with a margin of 24%. With operational discipline and a solid financial position, the company is well positioned to continue capturing opportunities in its key markets.

Celsia continued to capitalize on the normalization of weather conditions, with a more efficient and profitable generation business. Year-to-date, the company recorded revenue of COP 4.0 trillion and EBITDA of COP 1.3 trillion, achieving a margin of 32%. The company made progress in reducing consolidated net debt, with a net debt-to-EBITDA ratio of 3.14x, and expects an accelerated reduction of this figure in the coming quarters.

Odinsa delivered solid results, driven largely by the higher valuation, under the equity method, of its private equity fund, associated with the increased value of its assets due to the second stage of the Oriente Tunnel. Consolidated revenue reached COP 275 billion, representing year-over-year growth of 40%; EBITDA reached COP 194 billion, an increase of 45% versus the same period of the previous year; and consolidated net income totaled COP 175 billion, a 54% year-over-year increase.

Summary of Financial Statements

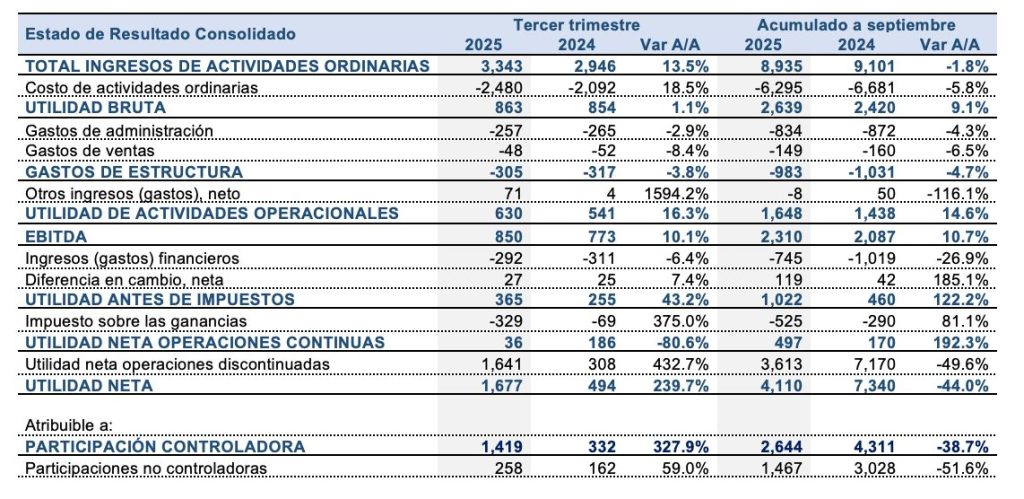

In order to provide a clear view of operating performance, Grupo Argos presents pro forma results that exclude the following non-recurring events:

- In 2025: as a result of the divestment in Grupo Sura, this quarter Grupo Argos recorded a gain of COP 1.6 trillion in the consolidated financial statements and COP 3.2 trillion in the separate financial statements. This effect is in addition to the gain from the sale of Summit Materials of COP 2.0 trillion and an accounting impairment on Cementos Argos’ assets in Puerto Rico.

- In 2024: gain from the combination of Argos USA and Summit Materials assets (COP 5.3 trillion), gain from the Nutresa share exchange (COP 1.4 trillion), accounting impairments due to adjustments in land (COP 200 billion), and the reclassification of Grupo Sura as a discontinued operation.

While the transactions described above are non-recurring and should be excluded when analyzing operating results, they are part of Grupo Argos’ ongoing work to continually maximize the value of its portfolio for the benefit of its shareholders.

Financial Statements of Recurring Operations

Pro forma figures exclude non-recurring transactions to make results comparable.

Financial Statements

Include non-recurring transactions.

Mas noticias

-

Financial results

Financial results -

Financial results

Financial resultsGrupo Argos reported a net income of COP 2.2 trillion in the first quarter of 2025

15 May 2025 Read more -

Financial results

Financial resultsGrupo Argos quintupled its consolidated net income in 2024, reaching COP 7.6 trillion, and will focus 100% on infrastructure

26 February 2025 Read more -

Financial results

Financial resultsGrupo Argos closed 2024 by more than tripling its separate net income, reaching COP 2.5 trillion.

30 January 2025 Read more -

Business

BusinessWith solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months

14 November 2024With solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months.

Read more