Grupo Argos’ operating net income grows 161% in 2025 and shareholders earn more than COP 1.5 trillion following the completion of the spin-off

14 August 2025- Excluding non-recurring events, EBITDA reached COP 1.5 trillion, increasing 6%, while net income totaled COP 514 billion, representing a 161% growth compared to the same period of the previous year.

- Following the completion of the Spin-off Project, Grupo Argos’ shareholders’ portfolio has appreciated by more than COP 1.5 trillion, including their shares in Grupo Argos and Grupo Sura. Additionally, shareholders will receive 50% more dividends through January 2026, taking into account the payments corresponding to Grupo Sura.

- Grupo Argos’ share price has tripled over the past two years, driven not only by strategic transactions that positioned the company as 100% focused on infrastructure, but also by the solid operating performance of its businesses.

- During the second quarter, Fitch Ratings and S&P Global confirmed the highest credit rating for Grupo Argos, reaffirming the company’s capacity to advance a new stage in its corporate history focused on infrastructure.

After completing the implementation of the Spin-off Project on July 26, Grupo Argos fulfilled all the commitments it had made to its shareholders and to the market when the transaction was presented to bring an end to the reciprocal shareholding with Grupo Sura: (i) the cross-shareholdings between the two companies were terminated in an orderly and efficient manner; (ii) equitable and transparent treatment was guaranteed for all shareholders; and (iii) going forward, each company will deepen its specialization and advance its strategy within its respective sector.

“Grupo Argos has entered a new stage that has created a virtuous circle for the company, its shareholders, and the capital market. The organization is strengthening its ability to attract capital and execute a project portfolio of nearly COP 40 trillion. All of its shareholders, in addition to holding an increased stake of more than 20% in the company, now also have a direct ownership in Grupo Sura. Finally, the Colombian capital market benefits from a stock with a free float close to 100% and greater liquidity.”

Jorge Mario Velásquez

CEO, Grupo Argos

The organization will focus its strategy and resources exclusively on its building materials and infrastructure businesses—sectors in which it has developed leadership and a proven track record—advancing an ambitious pipeline of projects that includes, among others:

- 1. Re-entering the U.S. market by exporting aggregates from the Caribbean basin, leveraging Cementos Argos’ logistics network and proven capabilities.

- 2. Doubling Celsia’s solar generation capacity in Colombia.

- 3. Expanding Celsia’s presence in Peru with renewable energy projects.

- 4. Expanding El Dorado Airport, Latin America’s main hub, and constructing a new airport in Cartagena.

- 5. Developing three Odinsa road projects, including the expansion of the Oriente Tunnel, already under construction.

- 6. Launching investments in the desalination and water treatment business in Latin America.

- 7. Advancing urban development in northern Barranquilla and boosting tourism in Barú Island.

Financial Results Driven by Operational Excellence: EBITDA and Net Income Grow Despite Lower Revenues

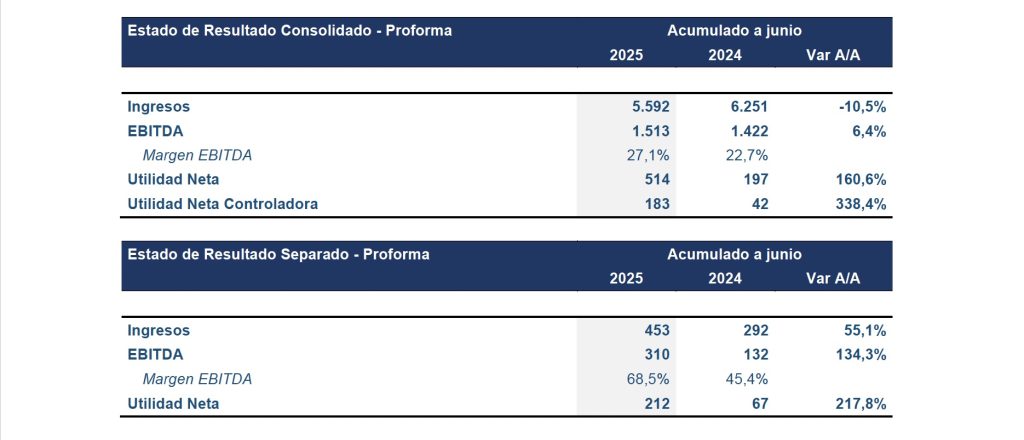

On the operational front, Grupo Argos reported its consolidated financial results for the first half of 2025. Excluding non-recurring operations, the company recorded growth in operating profitability and net income, driven by a more favorable environment for its electric power business, the appreciation of road and airport concession assets, and operational and financial discipline across all platforms.

In consolidated results, the company reported revenues of COP 5.6 trillion, down 10.5%, while EBITDA reached COP 1.5 trillion, up 6%. Net income year-to-date totaled COP 514 billion, a 161% increase compared to the same period in 2024. These results, excluding non-recurring effects, reflect the organization’s operational excellence and financial discipline.

Separately, revenues at the close of the second quarter stood at COP 453 billion, growing 55% year-over-year; EBITDA was COP 310 billion, up 134%; and net income reached COP 212 billion, a 218% increase compared to 2024.

In recent weeks, Cementos Argos completed the spin-off by absorption of its stake in Grupo Sura, releasing COP 1.4 trillion in direct benefits for its shareholders. Additionally, during the quarter, the company made decisive progress in the first phase of its strategy to re-enter the U.S. market through the consolidation of an aggregates platform, which, according to projections, could generate between USD 100 million and 150 million in additional EBITDA by 2030.

During the second quarter, Celsia reported revenues of COP 1.3 trillion and EBITDA of COP 442 billion, reaching an EBITDA margin of 33.6% following the normalization of hydropower generation. The company advanced its optimization program, ReimaginarC, with which it projects to close 2025 with net debt of approximately COP 3.9 trillion. In addition, Celsia made progress in creating a new energy efficiency platform that integrates already operational assets worth COP 620 billion and revenues of COP 150 billion.

Odinsa recorded revenues of COP 159 billion, growing 65%; EBITDA of COP 101 billion, up 69%; and net income of COP 87 billion, a 92% increase compared to the same period in 2024, driven by asset appreciation. Furthermore, the company recently achieved financial close of COP 1.8 trillion for the second phase of the Oriente Tunnel. This milestone reflects market confidence in the strength of the initiative and of the company, enabling the activation of all construction fronts, currently 12% complete.

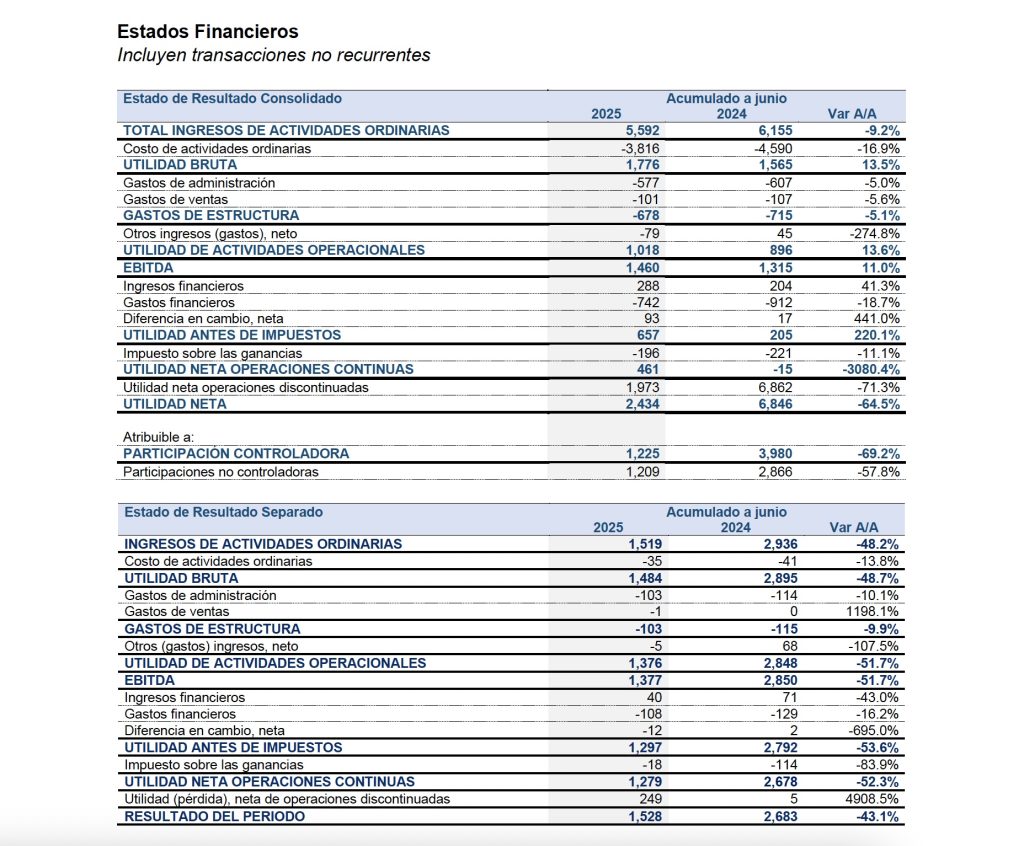

Summary of Financial Statements

To provide a clearer view of operational performance, Grupo Argos presents pro forma results that exclude the following non-recurring events:

2025:

- Profit from the sale of Summit Materials (COP 2.0 trillion)

- Expenses associated with the Spin-off Project

- Accounting impairment of Cementos Argos assets in Puerto Rico

- Exclusion of Grupo Sura from the equity method

2024:

- Profit from the combination of Argos USA and Summit Materials assets (COP 5.3 trillion)

- Profit from the swap with Nutresa (COP 1.4 trillion)

- Accounting impairments from property adjustments (COP 200 billion)

- Reclassification of Grupo Sura as a discontinued operation

Excluding these effects provides a more accurate view of the business’s structural growth.

Financial Statements of Recurring Operations

Pro forma figures exclude non-recurring transactions to ensure comparability of results.

Mas noticias

-

Financial results

Financial results -

Sustainability

SustainabilityGrupo Argos, Cementos Argos, Celsia and Odinsa reaffirm their position among Colombia’s most sustainable organizations, according to Merco ESG

25 February 2026 Read more -

Corporate

CorporateAccenture recognized Jorge Mario Velásquez, President of Grupo Argos, for his career and legacy during the launch of The Reinvention Community

24 February 2026 Read more -

Valor Económico

Valor EconómicoInvestor Day 2026 | Grupo Argos presented its 2030 roadmap, prioritizing shareholder returns, operational efficiency, and debt reduction

20 February 2026 Read more -

Business

BusinessOver the past three years, the value of Grupo Argos shareholders’ portfolio has increased by 2.74x.

18 February 2026 Read more