Business • Corporate

Grupo Argos Common Shareholders Gained Nearly COP 3,000 per Share in the First Week Following the Spin-Off

1 August 2025- Investors holding Grupo Argos common shares recorded a 12% increase in the value of their portfolios when considering the closing price of the common share on Friday, August 1, and the 0.23 Grupo Sura common shares they received for each Grupo Argos share held.

- Meanwhile, holders of Grupo Argos preferred shares saw a 9.3% increase in the value of their investment.

Grupo Argos shareholders experienced a significant appreciation in their investment during the first week of trading following the spin-off, which directly granted them COP 10.8 trillion in Grupo Sura shares. Taking into account the closing price on Friday, July 18 (the last trading day before the transaction), and the price on Friday, August 1, the total investment—now composed of Grupo Argos shares and the 0.23 Grupo Sura shares received per share—increased by more than COP 1.4 trillion.

Holders of Grupo Argos common shares recorded a 12% gain in their portfolios, while preferred shareholders experienced a 9.3% increase. This appreciation represents a direct and immediate financial benefit for more than 40,000 shareholders, including nearly 20 million Colombians represented through pension funds.

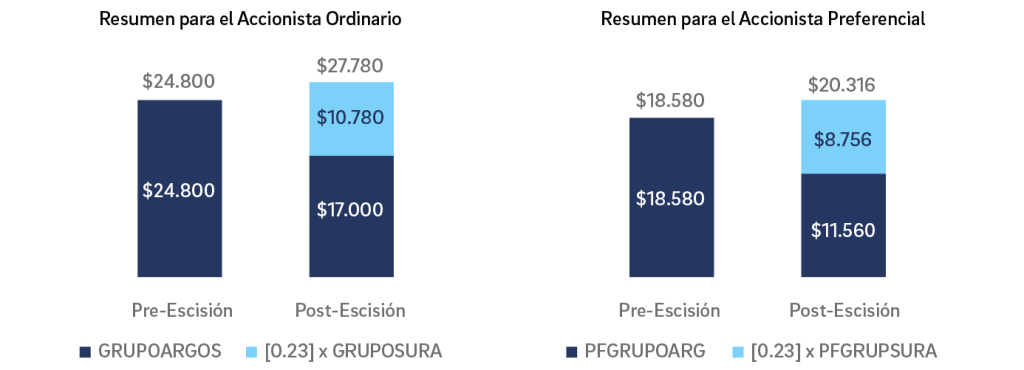

For common shares, this calculation includes the closing price of COP 17,000 for Grupo Argos’ common stock and the COP 10,780 corresponding to the 0.23 Grupo Sura common shares now held. In the case of preferred shares, it includes the closing price of COP 11,560 for Grupo Argos’ preferred stock and the COP 8,756 corresponding to the 0.23 Grupo Sura preferred shares received.

Beyond the initial positive impact for all shareholders, this transaction marks a turning point in Grupo Argos’ history: by simplifying its corporate structure and focusing exclusively on the infrastructure and building materials sectors, the company strengthens its value creation potential. Today, Grupo Argos companies boast robust operating platforms, expanding margins, a solid capital structure, and a project pipeline worth approximately COP 40 trillion.

In recent years, Grupo Argos’ portfolio streamlining and strategic focus have enabled the company to multiply its profits more than tenfold, reduce consolidated net debt from COP 13.3 trillion to nearly zero, and increase dividends per share by 157%. This combination of profitable growth, financial discipline, and strategic clarity now underpins the company’s stock appreciation and positions Grupo Argos as a modern, liquid, efficient platform with a strong ability to attract capital.

The following charts illustrate in detail the evolution of Grupo Argos shareholders’ portfolios before and after the spin-off:

Mas noticias

-

Corporate

Corporate -

Corporate

CorporateGrupo Argos delivered more than COP 11.5 trillion in returns to its shareholders during 2025

30 January 2026 Read more -

Corporate

CorporateGrupo Argos’ Board of Directors appointed Juan Esteban Calle as successor to Jorge Mario Velásquez as President of Grupo Argos, effective April 1, 2026

16 December 2025 Read more -

Corporate

CorporateGrupo Argos received COP 493,000 million from the share buyback of Cementos Argos

20 November 2025 Read more -

Corporate

CorporateGrupo Argos launches a liquidity formation program for its common and preferred shares

23 September 2025 Read more